Charlotte Real Estate: March 2023

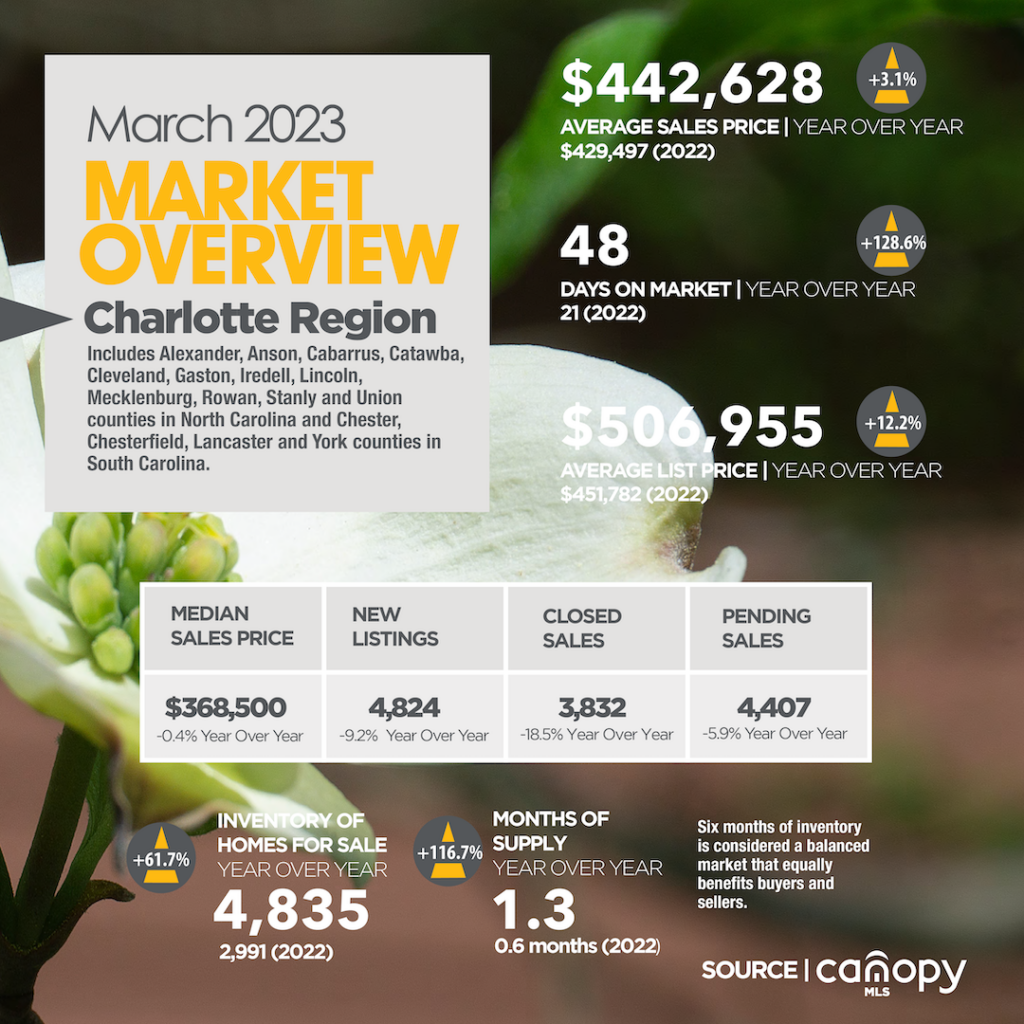

Charlotte real estate in March 2023 saw home sales decline 18.5% year-over-year, while home prices increased 3.1%, on average. Sales dropped for a 15th consecutive month due to higher home prices, increasing interest rates, and fewer new listings. Homes sold in 48 days, on average. The months supply of homes, while increasing, remained low at 1.3 months, keeping Charlotte in “home seller territory.” Home affordability continues to suffer.

Charlotte Real Estate Activity: March 2023

Charlotte real estate market in March 2023: latest news on the Charlotte Region and what it means for you…

March 2023 home sales declined year-over-year for a 15th consecutive month. Pending sales were also down year-over-year for a 15th consecutive month. Sales are happening, but not at the volumes experienced in 2021 and the first half of 2022. On the good news side, home sales increased in March 2023 over the previous month.

March 2023 home sales declined year-over-year for a 15th consecutive month. Pending sales were also down year-over-year for a 15th consecutive month. Sales are happening, but not at the volumes experienced in 2021 and the first half of 2022. On the good news side, home sales increased in March 2023 over the previous month.

Higher home prices coupled with increasing interest rates have impacted affordability and continue to cool buyer demand. The market in 2021 was clearly an anomaly and we can now see that year-over-year sales declines from 2022 appear significant. Sales are still occurring… just not at the pace of the last couple of years.

Home buyers are frustrated by higher rates, rising home prices, and economic uncertainty. Consequently, home sales and mortgage applications have fallen since last year as buying “power” declines. The typical mortgage paying will be higher (28% to $2,430), which will price buyers out of the market. Pending sales are a good indicator of future sales and buyer demand. We should expect fewer closed sales in the months to come. Furthermore, the fact that we also see fewer new listings coming on the market indicates Charlotte region will continue to experience inventory challenges, which impact home price appreciation.

Closed sales were down 18.5% (491 homes) year-over-year in March. Compared with February 2023, closed sales increased by 1,101 homes. Pending sales were also down 5.9% year-over-year. Month-over-month pending sales increased by 556 sales.

The real cost to buy a house has spiked over 55% since 2022, as the Federal Reserve raised rates seven times in 2022 and already three times in 2023. Mortgage rates topped 6% for the first time since 2008 and went over 7%. The Charlotte region housing affordability index continues to drop and impact sales volume. Housing affordability dropped 17% year-over-year by 19 points in March 2023.

Despite, fewer closed and pending sales, average list and sale prices increased in March 2023, year-over-year. Home prices are still increasing, but at a slower pace. Median sale price decreased 0.4% year-over-year, but is up 1.4% year-to-date. The median sale price is the best measure of price over time, as it factors out extreme highs and lows in home prices. Month-over-month, both the average sale price and the median sale price increased.

Housing inventory increased for a 10th consecutive month in March 2023. Inventory is up 61.7% compared to the same time last year. In March there were 1,844 more properties for sale than one year ago. Month-over-month, the number of properties for sale increased by 118.

The months supply of housing is up from 0.6 months to 1.3 months year-over-year. Month-over-month, the months supply of inventory was 0.1 months higher. The 1.3 months supply of homes keeps Charlotte region in “seller territory.” However, sellers don’t have the same strong position they had in previous years, with pricing key to attracting buyers and selling quickly. Although Charlotte Region is still technically a seller’s market, the days of receiving well over asking price are behind us and sellers need to reset their expectations.

While housing inventory has increased, new listing activity decreased 9.2% in March 2023 compared with March 2022, with 491 fewer properties listed. Month-over-month, Charlotte region saw 1,407 more listings come on market.

Averaging 48 days on market, the days on market increased 128.6% by 27 days year-over-year and were flat month-over-month. Pricing a home correctly is increasingly critical for sellers, as the “right” price brings buyers and results in fewer days on market.

With a list to sale price ratio of 96.2% in March 2023 (down 5.7% year-over-year, but up 0.9% month-over-month), buyers are carefully scrutinizing listing prices. Buyers may have more bargaining power now than at any point during the pandemic.

Moving forward into the spring selling season, both sellers and buyers continue to be distracted by growing economic concerns and negative housing headlines. The slowdown in home sales that began when mortgage rates increased in 2022 is expected to continue in the coming months. The costs to purchase a home will remain high, challenging affordability at a time when overall budgets continue to be squeezed by inflation. Buying power will remain on the decline with typical mortgage payments 28% higher on average, pricing many buyers out of the market.

Charlotte Region Real Estate Snapshot: March 2023

- Closed Sales: down 18.5% year-over-year; down 25.8% year-to-date.

- Homes Sold: 3,832 in March 2023 versus 4,702 in March 2022.

- Pending Sales: down 5.9% year-over-year; down 10.8% year-to-date.

- New Listings: down 9.2% year-over-year; down 14.7% year-to-date.

- Inventory of Homes: up 61.7% year-over-year to 4,835 compared with 2,991 in March 2022.

- Months Supply of Homes: up 116.7% with 1.3 months supply of homes compared with 0.6 months in March 2022.

- Days on Market Until Sale: 48 days in March 2023 versus 21 days in March 2022. Year-to-date, days on market are up 26 days year-over-year.

- Average Sale Price: up 3.1% year-over-year to $442,628. Year-to-date home prices were up 4.3% year-over-year.

- Median Sale Price: down 0.4% year-over-year to $368,500 (but up month-over-month). Year-to-date, median sale price was up 1.4%.

- % of Original List Price Received: 96.2%, decreasing 5.5% year-over-year (but up month-over-month); year-to-date, the list to sale price ratio was 95.5%, down 5.4%.

- Housing Affordability Index: down 17% year-over-year to 93 from 112; year-to-date, the affordability index was down 19% to 94 from 116.

Want to know what this would mean for your family if you decide to buy or sell a Charlotte region home?

We can help.

Call us today at 704-779-0813 or contact us here.

There’s absolutely NO OBLIGATION. A consultation with Carolinas Realty Partners is FREE.

MEDIAN HOME SALE PRICE TRENDS IN THE CHARLOTTE REGION

LOOKING FOR YOUR DREAM HOME IN THE CHARLOTTE AREA?

FREE Home Buyer Guide: “Things To Consider When Buying A Home”

WONDERING WHAT YOUR CHARLOTTE AREA HOME IS WORTH IN TODAY’S MARKET?

PRICING YOUR HOUSE RIGHT IS CRITICAL: VIDEO

FREE Home Seller Guide: “Things To Consider When Selling Your House”

THINKING OF SELLING YOUR HOME? CHECK OUT THE COLDWELL BANKER MARKETING ADVANTAGE

SEARCH ALL CHARLOTTE AREA HOMES FOR SALE

This Charlotte region housing market update for March 2023 is provided by Nina Hollander with Coldwell Banker Realty, Greater Charlotte area residential real estate experts serving Charlotte region home buyers and sellers for 24+ years.

If you’re considering selling or purchasing a home in the Charlotte region, I’d love an opportunity to earn your business, to exceed your expectations, and to show you why experience matters and how:

“The Right Broker Makes All The Difference.”

Find Your Charlotte Region Dream Home